BCOE-144 Solved Assignment 2025

Section – A

Question:-1

What is the meaning of office? What are the different types of offices? Discuss in detail.

Answer:

1. Introduction: The Concept and Evolution of Offices

The office serves as the operational nucleus of any organization, functioning as a dedicated space where administrative, managerial, and collaborative activities are conducted. Historically, offices have evolved from simple scribe rooms in ancient temples to sophisticated digital workspaces, reflecting broader shifts in technology, organizational structures, and work culture. Today, an office is not merely a physical location but a dynamic ecosystem designed to facilitate productivity, communication, and strategic decision-making.

2. Definition and Core Functions of an Office

An office is fundamentally defined as a structured environment where administrative, clerical, and managerial tasks are performed to support an organization's objectives. Its primary functions include:

- Workspace Provision: Offering a designated area equipped with tools and resources for employees to perform their duties efficiently.

- Communication Hub: Facilitating interaction through meetings, digital platforms, and collaborative zones.

- Administrative Center: Managing documentation, record-keeping, and data processing to ensure operational continuity.

- Strategic Coordination: Aligning departmental activities with organizational goals through planning and resource allocation.

These functions underscore the office's role as both an operational and symbolic entity, representing the organization's identity and professionalism.

3. Types of Offices

Modern workplaces employ diverse office types, each tailored to specific operational needs and work philosophies. Below is a detailed exploration of the most prevalent forms:

Traditional Offices

These include conventional setups such as:

- Private Offices: Enclosed spaces for executives or roles requiring confidentiality, offering solitude and minimal distractions.

- Cubicles: Semi-enclosed workstations balancing privacy with space efficiency, commonly used in corporate environments.

Flexible and Modern Workspaces

- Open-Plan Offices: Characterized by minimal partitions to foster collaboration and transparency, though sometimes critiqued for noise and lack of privacy.

- Co-Working Spaces: Shared environments where freelancers, startups, and remote workers access amenities like meeting rooms and high-speed internet, promoting networking and cost-efficiency.

- Hybrid Offices: Combine open and private areas, allowing employees to choose workspaces based on task requirements—e.g., quiet zones for focused work and communal tables for teamwork.

Specialized Offices

- Serviced Offices: Fully furnished and managed spaces leased with amenities like reception services and IT support, ideal for businesses seeking plug-and-play solutions.

- Virtual Offices: Provide a professional business address and communication services (e.g., mail handling) without physical workspace, catering to remote or digital-first companies.

- Activity-Based Workplaces (ABW): Feature varied zones (e.g., lounges, focus pods) tailored to specific tasks, enhancing flexibility and productivity.

Emerging Trends

- Home Offices: Personalized workspaces within residences, popularized by the rise of remote work.

- Mobile Offices: Leveraging portable technology to enable work from non-traditional locations like cafes or transit hubs.

4. Factors Influencing Office Design and Selection

The choice of office type depends on multiple factors:

- Organizational Culture: Collaborative cultures may favor open or hybrid layouts, while hierarchical structures might retain private offices.

- Nature of Work: Creative industries often thrive in open spaces, whereas legal or financial sectors may prioritize privacy.

- Technological Integration: Digital-native firms may opt for virtual or hybrid models, reducing reliance on physical infrastructure.

- Cost and Scalability: Startups might prefer co-working spaces for their affordability, while large corporations invest in customized headquarters.

Conclusion

The meaning and typology of offices have expanded significantly, driven by technological advancements and evolving work paradigms. From traditional cubicles to virtual setups, each office type offers distinct advantages tailored to organizational needs and employee preferences. As workplaces continue to adapt to global trends like remote work and sustainability, the future of offices will likely emphasize flexibility, inclusivity, and digital integration, ensuring they remain pivotal to organizational success.

Question:-2

"Roles are the expected behaviour of a job position." In light of this statement, discuss various roles an office manager is expected to play in an office.

Answer:

1. Introduction: Understanding the Multidimensional Role of an Office Manager

The office manager serves as the organizational linchpin, embodying a complex interplay of administrative, interpersonal, and strategic functions. As workplaces evolve in complexity, the office manager's role has transformed from a purely clerical position to a multifaceted leadership role that bridges operational execution with organizational vision. This position demands behavioral adaptability to meet diverse expectations from staff, executives, and external stakeholders while maintaining office efficiency.

2. Core Functional Roles of an Office Manager

Operational Architect The office manager designs and maintains systems for seamless daily operations. This includes developing filing protocols, optimizing workflow processes, and implementing space management strategies. They ensure office equipment functions properly and supplies remain stocked, often creating inventory tracking systems that prevent operational disruptions.

Financial Steward Managing petty cash flows and overseeing budget allocations for departmental expenses forms a critical responsibility. Office managers typically verify invoices, process vendor payments, and track expenditure against allocated budgets. In smaller organizations, they may collaborate with accounting departments to prepare financial reports.

3. Human-Centric Roles

Staff Coordinator Beyond scheduling meetings, office managers coordinate interdepartmental activities and resolve workflow conflicts. They serve as the first point of contact for employee concerns regarding workplace facilities or administrative support, often mediating between staff needs and organizational constraints.

Policy Implementer Office managers operationalize HR policies by monitoring attendance, leave balances, and compliance with workplace regulations. They frequently conduct office orientations for new hires, explaining administrative protocols and safety procedures while ensuring all necessary workstation preparations are complete.

4. Strategic Leadership Roles

Change Agent When organizations implement new technologies or processes, office managers lead the transition by training staff on new systems, addressing resistance, and troubleshooting implementation challenges. They evaluate the effectiveness of new office technologies before full-scale adoption.

Crisis Manager During emergencies ranging from IT outages to natural disasters, office managers activate contingency plans. They maintain emergency contact lists, oversee evacuation procedures, and coordinate recovery efforts to minimize operational downtime.

5. Evolving Contemporary Roles

Hybrid Work Facilitator With the rise of flexible work arrangements, office managers now coordinate hot-desking systems, manage shared calendars for physical workspace usage, and ensure remote employees have necessary resources. They balance the needs of in-office and remote teams through innovative scheduling tools.

Culture Curator Office managers intentionally shape workplace culture through event planning, recognition programs, and space design. They might organize team-building activities or decorate common areas to reflect organizational values, directly impacting employee morale and retention.

Conclusion

The modern office manager operates as a organizational polymath, simultaneously fulfilling operational, interpersonal, and visionary roles. This position requires behavioral flexibility to shift between detail-oriented administrative tasks and big-picture strategic thinking. As workplaces continue evolving, the office manager's role will likely expand further into technology management and employee experience design. What remains constant is the office manager's unique position as both the stabilizer of daily operations and the enabler of organizational transformation, making this role indispensable to organizational success. The behavioral expectations of this position ultimately reflect the complex, dynamic nature of contemporary work environments where efficiency must coexist with adaptability.

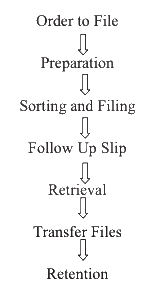

Question:-3

What are the Steps of filing procedure? Explain with diagram.

Answer:

Steps of Filing Procedure

An efficient filing system ensures easy retrieval, security, and organization of documents. Below are the key steps involved in a standard filing procedure:

1. Preparation of Documents

- Collect all documents to be filed (letters, invoices, reports, etc.).

- Sort them by category (e.g., department, date, project).

- Remove unnecessary papers like duplicates or outdated drafts.

2. Classification & Indexing

- Categorize files based on a logical system:

- Alphabetical (by name, subject)

- Numerical (by file number)

- Chronological (by date)

- Geographical (by location)

- Assign reference codes for quick retrieval (e.g., FIN/2024/001 for finance records).

3. Filing

- Choose a filing method:

- Vertical Filing (folders placed upright in cabinets)

- Horizontal Filing (documents stacked in flat files)

- Digital Filing (using cloud storage or DMS like SharePoint)

- Label folders clearly with consistent naming conventions.

- Place documents in designated folders, ensuring no overstuffing.

4. Cross-Referencing (if needed)

- Create cross-reference sheets for files that belong to multiple categories.

- Example: A contract with a vendor may be filed under both "Vendors" and "Contracts."

5. Maintenance & Updating

- Regularly review files to archive or discard outdated records.

- Backup digital files to prevent data loss.

- Audit the filing system periodically for efficiency.

6. Retrieval & Security

- Track file movements (use a logbook for physical files or digital access logs).

- Restrict access to confidential files (e.g., password protection for digital files, locked cabinets for physical records).

Conclusion

A systematic filing procedure enhances productivity, reduces document loss, and ensures compliance with data retention policies. Whether physical or digital, consistency in labeling, categorization, and maintenance is key to an effective system.

Question:-4

Define the term quorum and explain what constitutes a quorum. What steps should a chairman take if quorum is absent or not maintained throughout the meeting?

Answer:

1. Introduction: The Fundamental Concept of Quorum

A quorum represents the minimum number of members required to be present at a meeting to validate its proceedings and decisions. This foundational principle of parliamentary procedure ensures that organizational actions reflect collective will rather than individual preferences. The concept originated in British common law and has become a universal standard for deliberative bodies, from corporate boards to legislative assemblies. Quorum requirements protect against unilateral decision-making while balancing the practical need for operational efficiency when full attendance proves unattainable.

2. Legal and Functional Definition of Quorum

The precise composition of a quorum varies across organizations but typically derives from three possible benchmarks:

Fixed Number Systems

Some organizations specify an absolute number (e.g., "five members") regardless of total membership. This works well for small, stable groups where consistent participation is expected.

Percentage-Based Thresholds

Most commonly, governing documents establish a percentage of total membership (typically 1/3 to 1/2) to constitute quorum. For a 12-member board with a 50% requirement, six members must attend.

Tiered Requirements

Sophisticated organizations may implement graduated standards – higher thresholds for major decisions (like mergers) and lower for routine matters.

The determination always stems from an organization's constitutive documents: articles of incorporation for corporations, standing orders for legislatures, or bylaws for associations. Where silent, default provisions in jurisdiction-specific corporate laws or parliamentary authorities (like Robert's Rules) apply.

3. Chairman's Protocol for Quorum Deficiencies

Pre-Meeting Absence

When insufficient members attend at the scheduled start time, the chair should:

- Verify the shortfall through roll call or visual confirmation

- Allow a grace period (15-30 minutes) for late arrivals

- Adjourn the meeting if quorum remains unachieved, recording the attempt in minutes

- Schedule the next attempt following notice requirements

Mid-Meeting Attrition

If members depart during proceedings causing quorum loss:

- Suspend deliberation upon recognition of the deficiency

- Confirm the count through formal verification

- Entertain privileged motions (like adjournment or recess)

- Nullify substantive decisions made post-quorum loss

Strategic Follow-Up

The chair must:

- Document the circumstances meticulously in meeting minutes

- Analyze patterns of absenteeism for governance reforms

- Propose bylaw amendments if quorum requirements prove chronically impractical

- Explore remote participation options to improve accessibility

4. Exceptional Circumstances and Modern Adaptations

Emergency Provisions

Some organizations authorize "quorum-of-the-present" rules during crises, allowing attending members to conduct urgent business after documented failed attempts to convene normally.

Technological Integration

Contemporary practices increasingly recognize electronic presence through video conferencing as valid for quorum purposes, provided authentication protocols prevent impersonation.

Proxy Solutions

Where permitted, proxy voting systems aggregate absent members' voting rights to present attendees, though this remains controversial in many deliberative bodies.

Conclusion

Quorum requirements serve as both a safeguard against arbitrary governance and a potential obstacle to organizational agility. The chairman's role in managing quorum issues demands equal parts procedural rigor and practical wisdom – enforcing constitutional requirements while preventing procedural technicalities from paralyzing essential operations. As work cultures evolve with hybrid participation models, quorum standards must similarly adapt without sacrificing their fundamental democratic purpose. Effective chairs transform quorum management from an administrative hurdle into an opportunity to reinforce institutional legitimacy and member engagement.

Question:-5

What is Audit? Why is it important?

Answer:

1. Introduction: The Fundamental Concept of Audit

Audit represents a systematic, independent examination of records, statements, operations, and performances to verify their accuracy, validity, and compliance with established standards. This evaluative process serves as a critical governance mechanism across financial, operational, and regulatory domains, providing stakeholders with assurance about the reliability of information and effectiveness of controls. The practice of auditing has evolved from simple verification of financial transactions in ancient civilizations to a sophisticated multidisciplinary function encompassing risk assessment, compliance verification, and strategic advisory in contemporary organizations.

2. Defining the Audit Process

At its core, auditing involves three essential components: evidence collection, evaluation against criteria, and opinion formulation. The process typically follows a structured methodology:

Planning Phase Auditors develop risk-based approaches to examine areas of material significance, determining scope, objectives, and resource allocation. This stage includes understanding organizational processes, identifying key controls, and establishing materiality thresholds.

Execution Phase Through inspection, observation, confirmation, and recalculation techniques, auditors gather sufficient appropriate evidence. Modern audits increasingly leverage data analytics tools to examine complete datasets rather than relying solely on sample-based testing.

Reporting Phase Findings are synthesized into formal opinions (unqualified, qualified, adverse, or disclaimer) accompanied by management letters highlighting control weaknesses and improvement recommendations. The reporting standards vary by audit type – financial audits follow accounting frameworks while operational audits use performance metrics.

3. Primary Types of Audits

Financial Audits Examine the fairness and accuracy of financial statements, ensuring compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These are typically mandatory for publicly traded companies.

Internal Audits Conducted by in-house professionals to evaluate risk management, governance processes, and internal controls. The Institute of Internal Auditors' standards guide these assessments which focus on adding organizational value.

Compliance Audits Verify adherence to laws, regulations, and contractual obligations. Common in heavily regulated industries like healthcare (HIPAA) and finance (SOX).

Performance Audits Assess the economy, efficiency, and effectiveness of operations, programs, or functions. Government entities frequently employ these to evaluate public spending.

Information Systems Audits Review IT infrastructure, data integrity, and cybersecurity controls, becoming increasingly crucial in the digital economy.

4. The Critical Importance of Auditing

Governance and Accountability Audits serve as a check against mismanagement and fraud by creating transparency in organizational affairs. The independent verification mechanism deters financial misrepresentation and promotes ethical conduct among management.

Investor Confidence Reliable audited financial statements enable investors to make informed capital allocation decisions. The audit assurance reduces information asymmetry between company insiders and external stakeholders.

Regulatory Compliance Many jurisdictions mandate statutory audits to protect public interest. Listed companies, banks, and insurance firms undergo rigorous audits to maintain operating licenses.

Operational Improvement Internal and performance audits identify inefficiencies, control gaps, and best practices. The resulting recommendations help optimize processes and resource utilization.

Risk Mitigation By systematically evaluating control environments, audits help organizations proactively address financial, operational, and strategic risks before they materialize into crises.

Fraud Prevention and Detection While not primarily designed as fraud investigation tools, audits create an environment of scrutiny that discourages malfeasance and often uncovers irregularities through control testing.

5. Emerging Audit Imperatives

The audit function continues evolving to address contemporary challenges:

Sustainability Auditing With growing emphasis on ESG (Environmental, Social, and Governance) factors, auditors now verify non-financial disclosures related to carbon emissions, diversity metrics, and supply chain ethics.

Digital Transformation Blockchain verification, continuous auditing through AI, and advanced data analytics are revolutionizing traditional audit methodologies.

Globalization Challenges Multinational operations require coordinated audits across jurisdictions with differing regulations and business practices.

Conclusion

Auditing constitutes an indispensable pillar of organizational integrity and market confidence. Its importance transcends simple compliance to become a strategic function that enhances decision-making quality, safeguards stakeholder interests, and promotes sustainable business practices. As business environments grow more complex, the audit profession must continuously adapt its approaches while maintaining the fundamental principles of independence, objectivity, and professional skepticism that give the process its credibility. The future of auditing lies in balancing technological innovation with human judgment to provide meaningful assurance in an increasingly interconnected and transparent world.

Section – B

Question:-6

Explain the concept of virtual office.

Answer:

Concept of Virtual Office

A virtual office is a modern business solution that provides organizations with a professional address, communication services, and operational support without requiring a physical workspace. It enables businesses, especially startups, freelancers, and remote teams, to establish a professional presence without the overhead costs of traditional office space.

Key Features:

- Business Address: A prestigious mailing address for formal correspondence, often in prime locations.

- Communication Services: Includes call answering, mail handling, and virtual receptionist support.

- Meeting Spaces: Access to physical meeting rooms or coworking spaces on a pay-per-use basis.

- Digital Infrastructure: Cloud-based tools for virtual collaboration (e.g., video conferencing, document sharing).

Benefits:

- Cost-Efficiency: Eliminates expenses like rent, utilities, and office maintenance.

- Flexibility: Supports remote and hybrid work models, allowing employees to work from anywhere.

- Scalability: Easily adaptable for growing businesses without long-term lease commitments.

- Professional Image: Enhances credibility with a recognized business address and dedicated phone services.

Use Cases:

- Startups and SMEs looking to minimize operational costs.

- Global teams needing a local presence in multiple regions.

- Freelancers and consultants seeking a professional identity without physical office constraints.

Conclusion

Virtual offices bridge the gap between traditional office setups and modern remote work trends, offering flexibility, cost savings, and professional credibility. As digital transformation accelerates, virtual offices are becoming an essential tool for agile and geographically dispersed businesses.

Question:-7

What is line organization? Discuss its advantages and disadvantages.

Answer:

Line Organization: Advantages and Disadvantages

Definition:

Line organization is the simplest and oldest form of organizational structure, where authority flows vertically from top to bottom. It follows a clear chain of command, with each employee reporting directly to one superior. This structure is common in small businesses and military organizations.

Advantages:

- Clear Authority: Direct lines of responsibility eliminate confusion about roles and decision-making.

- Quick Decision-Making: With fewer hierarchical layers, approvals and instructions are communicated faster.

- Discipline & Control: Strict supervision ensures efficient task execution and accountability.

- Cost-Effective: Minimal administrative overhead reduces operational costs.

- Easy Coordination: Departments work independently with clearly defined responsibilities.

Disadvantages:

- Overburdened Superiors: Managers handle multiple responsibilities, leading to inefficiency.

- Lack of Specialization: Employees perform generalized tasks, limiting expertise development.

- Rigidity: Inflexible structure discourages innovation and adaptability.

- Communication Barriers: Information flows only vertically, causing delays and misunderstandings.

- Employee Stress: Excessive dependence on a single superior can create pressure and low morale.

Conclusion:

Line organization suits small firms requiring strict control but struggles in complex, dynamic environments. While it promotes efficiency and simplicity, its rigidity and lack of specialization make it less effective for large, innovative enterprises.

Question:-8

What are the essential qualities of indexing?

Answer:

Essential Qualities of Effective Indexing

A well-designed indexing system is crucial for efficient document retrieval and information management. The following qualities ensure optimal performance:

1. Accuracy

- Entries must precisely reflect content without errors.

- Correct cross-references prevent misdirection.

2. Consistency

- Uniform formatting (e.g., capitalization, abbreviations).

- Standardized terminology avoids confusion.

3. Completeness

- Covers all significant topics, names, and concepts.

- Includes alternate terms (synonyms) for comprehensive searchability.

4. Logical Arrangement

- Alphabetical, numerical, or chronological order for intuitive navigation.

- Hierarchical structuring (main entries with sub-entries) enhances clarity.

5. Conciseness

- Avoids unnecessary details while retaining key information.

- Uses clear, succinct phrasing.

6. Accessibility

- User-friendly design with visible labels.

- Digital indexes should support keyword searches.

7. Adaptability

- Scalable to accommodate new entries.

- Flexible enough to incorporate emerging categories.

8. Speed

- Enables quick retrieval through efficient organization.

- Minimizes search time with logical groupings.

Applications

Effective indexing is vital for:

- Libraries (cataloging books)

- Legal documents (case law references)

- Corporate records (HR or financial files)

Conclusion

A high-quality index balances precision with usability, ensuring seamless access to information. By incorporating accuracy, consistency, and logical structure, indexing systems enhance productivity across various domains.

Question:-9

What are the various benefits of upgrading outdated office equipment?

Answer:

Benefits of Upgrading Outdated Office Equipment

Replacing obsolete office equipment with modern technology offers significant advantages that enhance productivity, efficiency, and workplace satisfaction.

1. Increased Productivity

- Faster processors, advanced software, and high-speed printers reduce task completion time.

- Automation features minimize manual work, allowing employees to focus on strategic activities.

2. Cost Savings

- Energy-efficient devices (e.g., LED monitors, smart HVAC systems) lower utility bills.

- Reduced maintenance and repair costs for outdated machinery.

3. Improved Employee Morale

- Modern ergonomic equipment (adjustable chairs, sit-stand desks) boosts comfort and reduces fatigue.

- User-friendly interfaces and reliable tools decrease frustration and stress.

4. Enhanced Security

- Up-to-date systems include advanced cybersecurity protections against data breaches.

- Regular software updates patch vulnerabilities, safeguarding sensitive information.

5. Competitive Advantage

- Cutting-edge technology (AI tools, cloud collaboration platforms) streamlines workflows.

- Faster response times and better service quality strengthen client relationships.

6. Sustainability

- Eco-friendly equipment reduces carbon footprints and supports corporate sustainability goals.

- Digital workflows minimize paper waste.

7. Compliance & Scalability

- Newer devices meet current industry regulations (e.g., data privacy laws).

- Scalable solutions adapt to business growth without frequent replacements.

Conclusion

Investing in modern office equipment optimizes operations, reduces long-term costs, and fosters a progressive work environment. Businesses that prioritize upgrades gain efficiency, security, and a competitive edge in evolving markets.

Question:-10

Why is the budget referred to as the financial barometer of the firm?

Answer:

The Budget as a Financial Barometer of the Firm

A budget serves as the financial barometer of a firm, providing critical insights into its fiscal health, operational efficiency, and strategic direction. Much like a barometer measures atmospheric pressure to predict weather changes, a budget gauges financial performance to anticipate risks and opportunities.

1. Performance Measurement

- Compares actual financial outcomes with projected figures, highlighting variances.

- Identifies inefficiencies in revenue generation or cost management.

2. Strategic Planning

- Allocates resources to priority areas, ensuring alignment with business goals.

- Guides investment decisions by forecasting cash flows and profitability.

3. Risk Mitigation

- Flags potential shortfalls or overspending early, enabling corrective action.

- Acts as an early warning system for liquidity crises or unsustainable expenses.

4. Operational Control

- Sets spending limits for departments, preventing wasteful expenditures.

- Encourages accountability by assigning financial targets to teams.

5. Stakeholder Confidence

- Demonstrates fiscal discipline to investors, lenders, and shareholders.

- Enhances credibility by showcasing the firm’s ability to plan and adapt.

6. Adaptability

- Flexible budgets adjust to market fluctuations, ensuring resilience.

- Supports scenario planning for economic downturns or expansion opportunities.

Conclusion

As a financial barometer, the budget provides real-time feedback on the firm’s fiscal condition, enabling proactive decision-making. By monitoring this vital tool, businesses can navigate uncertainties, optimize resources, and sustain long-term growth.

Section – C

Question:-11

What is meant by office etiquette?

Answer:

Office Etiquette: Meaning and Importance

Office etiquette refers to the unwritten code of conduct that governs professional behavior in the workplace. It encompasses manners, communication norms, and respectful interactions that create a harmonious and productive work environment.

Key Aspects of Office Etiquette:

- Professional Communication – Using polite language, active listening, and appropriate tone in emails and meetings.

- Punctuality – Arriving on time for work, meetings, and deadlines to show respect for others' time.

- Respect for Privacy – Knocking before entering offices, avoiding eavesdropping, and maintaining confidentiality.

- Workspace Cleanliness – Keeping shared spaces tidy and respecting others' work areas.

- Dress Code Adherence – Following the company’s dress policy to maintain professionalism.

- Technology Use – Muting devices during meetings, avoiding excessive personal calls, and using professional email etiquette.

Why It Matters?

Good office etiquette fosters a positive work culture, reduces conflicts, and enhances teamwork. It reflects an employee’s professionalism and contributes to career growth by building trust and credibility.

Conclusion

Office etiquette is essential for maintaining workplace harmony and efficiency. By practicing courtesy and respect, employees create a conducive environment for collaboration and success.

Question:-12

What are the advantages and disadvantages of digital publishing platforms?

Answer:

Advantages and Disadvantages of Digital Publishing Platforms

Advantages:

- Global Reach – Digital platforms allow content to be accessed worldwide, expanding audience reach beyond geographical limits.

- Cost-Effective – Eliminates printing, distribution, and storage costs, making publishing more affordable.

- Instant Updates – Content can be revised in real-time without reprinting, ensuring accuracy and relevance.

- Interactive Features – Supports multimedia elements (videos, hyperlinks, animations) for an engaging reader experience.

- Eco-Friendly – Reduces paper waste, contributing to environmental sustainability.

- Analytics & Personalization – Tracks reader behavior and preferences, enabling targeted content delivery.

Disadvantages:

- Digital Fatigue – Overexposure to screens may reduce reader engagement over time.

- Piracy Risks – Easier unauthorized sharing and duplication of content.

- Technical Barriers – Requires digital literacy and access to devices/internet, excluding some audiences.

- Revenue Challenges – Monetization can be difficult due to free content expectations.

- Platform Dependence – Reliance on third-party platforms (e.g., Amazon, Apple Books) may limit control over distribution.

Conclusion

While digital publishing offers accessibility and innovation, it also presents challenges like piracy and monetization. Balancing these factors is key to leveraging its full potential.

Question:-13

Enlist the various steps required to be taken to append a file while sending an e-mail.

Answer:

Steps to Append a File While Sending an Email

- Open Your Email Client – Launch Gmail, Outlook, or any other email service.

- Compose a New Email – Click on "Compose" or "New Message."

- Enter Recipient Details – Add the recipient’s email address in the "To" field.

- Add a Subject & Body – Write a clear subject line and brief message.

- Locate the Attachment Option – Look for the paperclip (📎) or "Attach File" icon.

- Select the File – Browse your device and choose the document, image, or file to attach.

- Upload the File – Wait for the file to upload (larger files may take time).

- Verify Attachment – Ensure the file appears in the email before sending.

- Send the Email – Click "Send" once everything is ready.

Additional Tips:

- Compress large files (using ZIP) to avoid delivery issues.

- Mention attachments in the email body to alert the recipient.

- Double-check file permissions if sharing confidential documents.

Conclusion

Appending files to emails is simple but requires attention to ensure successful delivery. Following these steps ensures smooth communication.

Question:-14

What are the steps for doing online payments?

Answer:

Steps for Making Online Payments

- Select Payment Method – Choose a digital payment option (credit/debit card, UPI, net banking, e-wallet, or PayPal).

- Enter Payment Details – Input card number, expiry date, CVV, or UPI ID as required.

- Verify Transaction Amount – Confirm the payment sum and currency.

- Authenticate Payment – Complete security steps like OTP (SMS/email), PIN, or biometric verification.

- Await Confirmation – Check for a success message or transaction ID.

- Save Receipt – Download or screenshot the payment confirmation for records.

Safety Tips:

✔ Use secure networks (avoid public Wi-Fi).

✔ Verify website legitimacy (look for "https://" and padlock icons).

✔ Enable transaction alerts for real-time monitoring.

Common Platforms:

- E-commerce (Amazon, Flipkart)

- Bill Payments (Electricity, mobile recharge)

- Bank Apps/UPI (Google Pay, PhonePe, Paytm)

Conclusion

Online payments offer speed and convenience but require caution to prevent fraud. Following these steps ensures smooth and secure transactions.